About Allspring

Leveraging decades of experience and core investment roots, Allspring’s vision is to inspire a new era of investing that pursues both financial returns and positive outcomes. Diverse perspectives power our investment strategies through a unified platform and a commitment to our clients.

As of September 30, 2025. Figures include discretionary and non-discretionary assets.

The Allspring advantage

Who we are

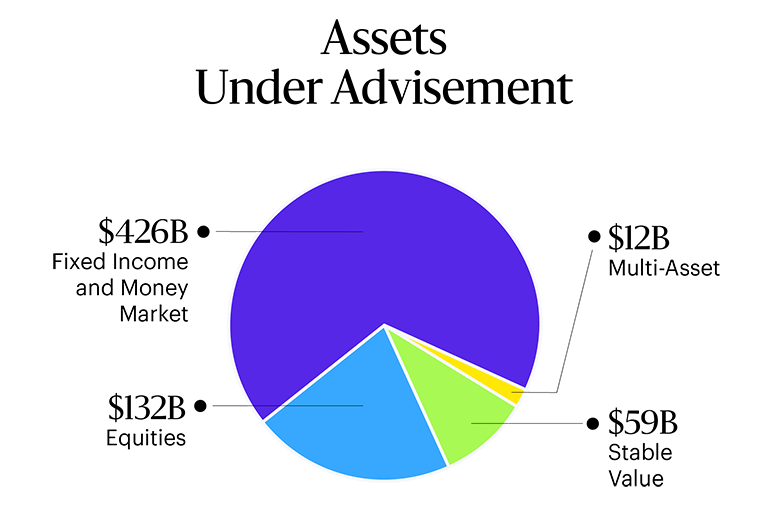

Assets under advisement

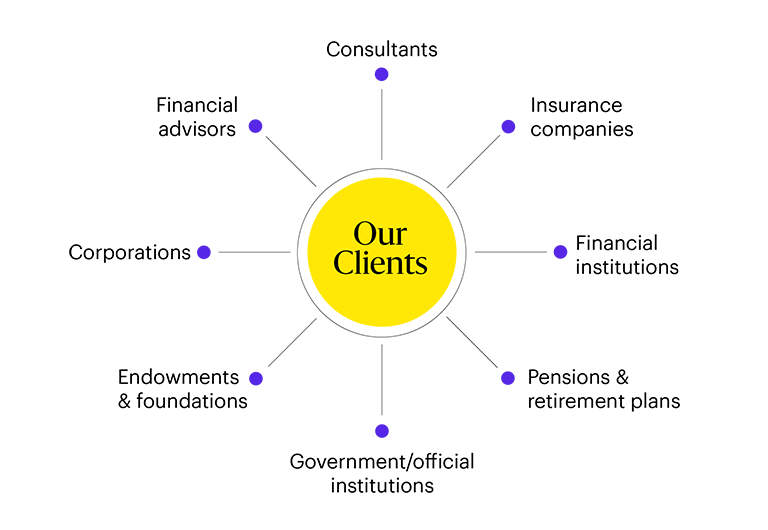

Our clients

Extensive coverage of strategies

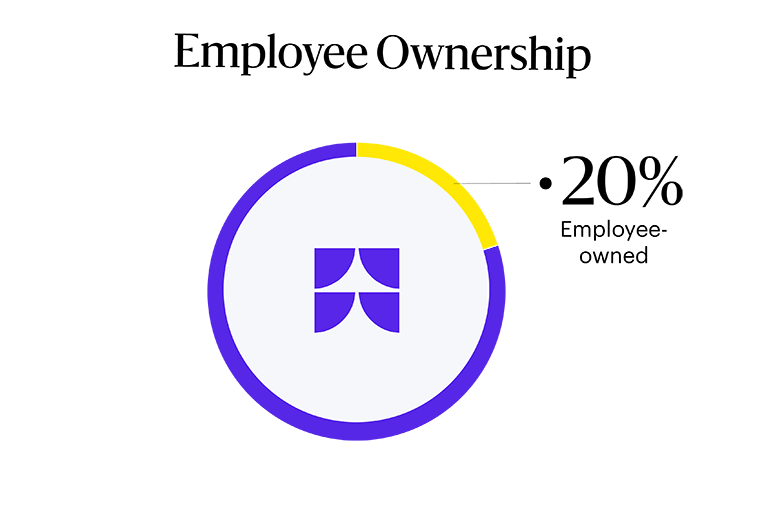

Allspring ownership

Assets under advisement

As of 9/30/2025. Figures include discretionary and non-discretionary assets.

Our clients

We’re devoted to delivering tailor-made investment solutions to our clients, aiming for consistent, risk-adjusted returns to achieve positive outcomes.

Extensive coverage of strategies

Our broad array of investment strategies caters to diverse financial objectives, offering versatility and scope. Figures from Allspring and affiliates, as of 9/30/2025.

Allspring ownership

Our corporate structure is designed to drive alignment of interest with clients and retention, encouraging unparalleled dedication and insight.

What we believe

We firmly believe that bringing together multiple perspectives empowers creativity and innovation, a deeper understanding of our clients, and the ability to see business opportunities in new ways. Our leaders are dedicated to delivering Allspring’s vision to inspire a new era of investing that pursues both financial returns and positive outcomes.

We firmly believe that bringing together multiple perspectives empowers creativity and innovation, a deeper understanding of our clients, and the ability to see business opportunities in new ways. Our leaders are dedicated to delivering Allspring’s vision to inspire a new era of investing that pursues both financial returns and positive outcomes.

Joe Sullivan, Executive Chair, Board of Directors of Allspring Global Investments